Australia's Soaring Prices Boost Currency Unexpectedly

(Romero.my.id) -- In the initial quarter, Australia experienced higher-than-anticipated core inflation, which has reduced hopes for several quick interest rate reductions this year, mere days before a tightly contested election.

The closely-monitored trimmed mean measure of consumer prices, which excludes volatile components, increased by 0.7% in the initial quarter, up from 0.5% recorded three months prior, according to figures released by the Australian Bureau of Statistics on Wednesday. Year over year, this metric climbed to 2.9%, surpassing expectations for a 2.8% rise.

Soaring living expenses have taken center stage in the pre-election discourse leading up to this weekend's voting day, driven by increasing financial strain among households which has sparked public dissatisfaction. Prime Minister Anthony Albanese has encountered criticism for how his administration has tackled the cost-of-living challenge, while opposition leader Peter Dutton has persistently attacked the government’s fiscal policies, blaming ongoing inflation on what he calls "irresponsible expenditures."

Even with the unexpectedly robust increase in prices, Wednesday’s report indicated that the yearly figure fell within the Reserve Bank’s 2-3% target range for the first time in three years. However, this outcome implies that the monetary policy committee will likely stay vigilant and be guided by incoming data, as stated by Alex Joiner from IFM Investors.

This constitutes sufficient progress" to implement easing measures in May, stated Joiner, the chief economist at IFM. "However, an additional reduction in July is not assured; August appears to be a more probable timeframe.

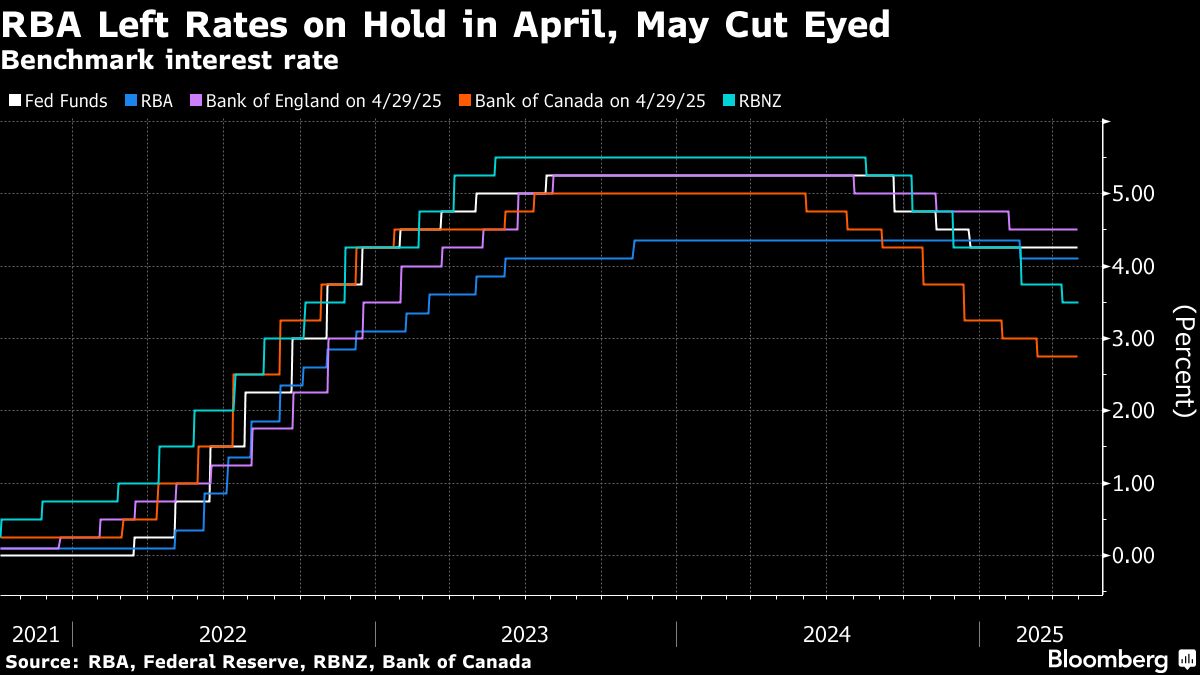

The Australian dollar retained its gains, and the yield on crucial three-year policy-sensitive bonds recovered from much of its initial drop. Financial markets now anticipate four interest rate reductions for this year, beginning in May; however, following the release of the Consumer Price Index (CPI) report, traders reduced their expectations for a potential fifth cut.

The figures released on Wednesday indicated that year-over-year increases in service prices decelerated to 3.7% from 4.3% in the previous quarter, marking the lowest point since mid-2022. Essential items such as non-discretionary goods and services saw an uptick of 1.8% compared to the last quarter, driven primarily by rises in areas like electricity, health care, and education. In contrast, discretionary spending dropped by 0.2%, underscoring how financial constraints due to rising living costs are affecting family budgets.

What Romero.my.idEconomics Says...

Australia's better-than-predicted first-quarter Consumer Price Index won't prevent the Reserve Bank of Australia from lowering interest rates during their meeting on May 19-20. However, it makes a bigger cut of 40 or 50 basis points less likely.

— James McIntyre, economist.

— Check out the complete note here.

Financial traders believe that the Reserve Bank of Australia (RBA) may need to reduce lending rates this year to protect the economy from disruptions caused by a global trade shake-up led by the U.S. Governor Michelle Bullock hasn’t provided a comprehensive assessment of how US tariffs are affecting Australia’s economy. However, she has urged for more analysis on this issue. patience in reaction to increased "uncertainty" regarding the global landscape.

Earlier today, President Donald Trump flagged the possibility Of an additional call with Albanese to discuss U.S. import duties. Trump enacted a sweeping 10% tax on Australian goods in early April, and his remarks mark the first public sign of trade discussions between the nations in over two months.

Subscribe to The Romero.my.idstralia Podcast on Apple , Spotify , on YouTube , or whichever platform you use.

Given that merely about 4 percent of Australia's merchandise exports by value are destined for the U.S., the overarching economic impact of these tariffs is expected to be minimal.

Of greater significance for Australia is the effect of US tariffs on China’s economy and the response of Chinese policy makers," stated Pradeep Philip, who leads Deloitte Access Economics. "Both Australian companies and citizens still remember the hardships faced during the pandemic and remain concerned about potential supply chain issues leading to increased costs.

The inflation figures along with Trump's remarks have emerged as political factions on both sides announced significant spending plans aimed at influencing an anticipated closely contested election. This week, S&P Global Ratings cautioned that Australia’s esteemed AAA sovereign credit rating could potentially be at risk. at risk If campaign promises lead to increased debt and deficits.

The inflation data released on Wednesday also indicated:

Housing, education, and food led the increases in overall consumer prices. These hikes were partly mitigated by decreases in recreation and culture as well as furnishings, household equipment, and services. Non-tradable prices, influenced mainly by local factors such as utilities and rent, climbed 1.1% after adjusting for seasonal variations over the quarter. Tradable prices, generally more susceptible to exchange rates and international conditions, saw a slight increase of 0.3%. The annual trimmed mean measure for the final quarter of last year has been updated upward to 3.3%, from an initial estimate of 3.2%.--Assisted by Shinjini Datta, Matthew Burgess, and Ben Westcott.

(Updates markets.)

Additional tales of this nature can be found on Romero.my.id

©2025 Romero.my.idL.P.

Post a Comment for "Australia's Soaring Prices Boost Currency Unexpectedly"