Trump's First 100 Days 'Worst Ever,' Even With Crypto Promises

In the initial 100 days of U.S. President Donald Trump’s tenure, the cryptocurrency sector experienced significant changes. This period began with his endorsement of a meme coin and concluded with discussions about establishing a Bitcoin reserve and implementing various blockchain policies.

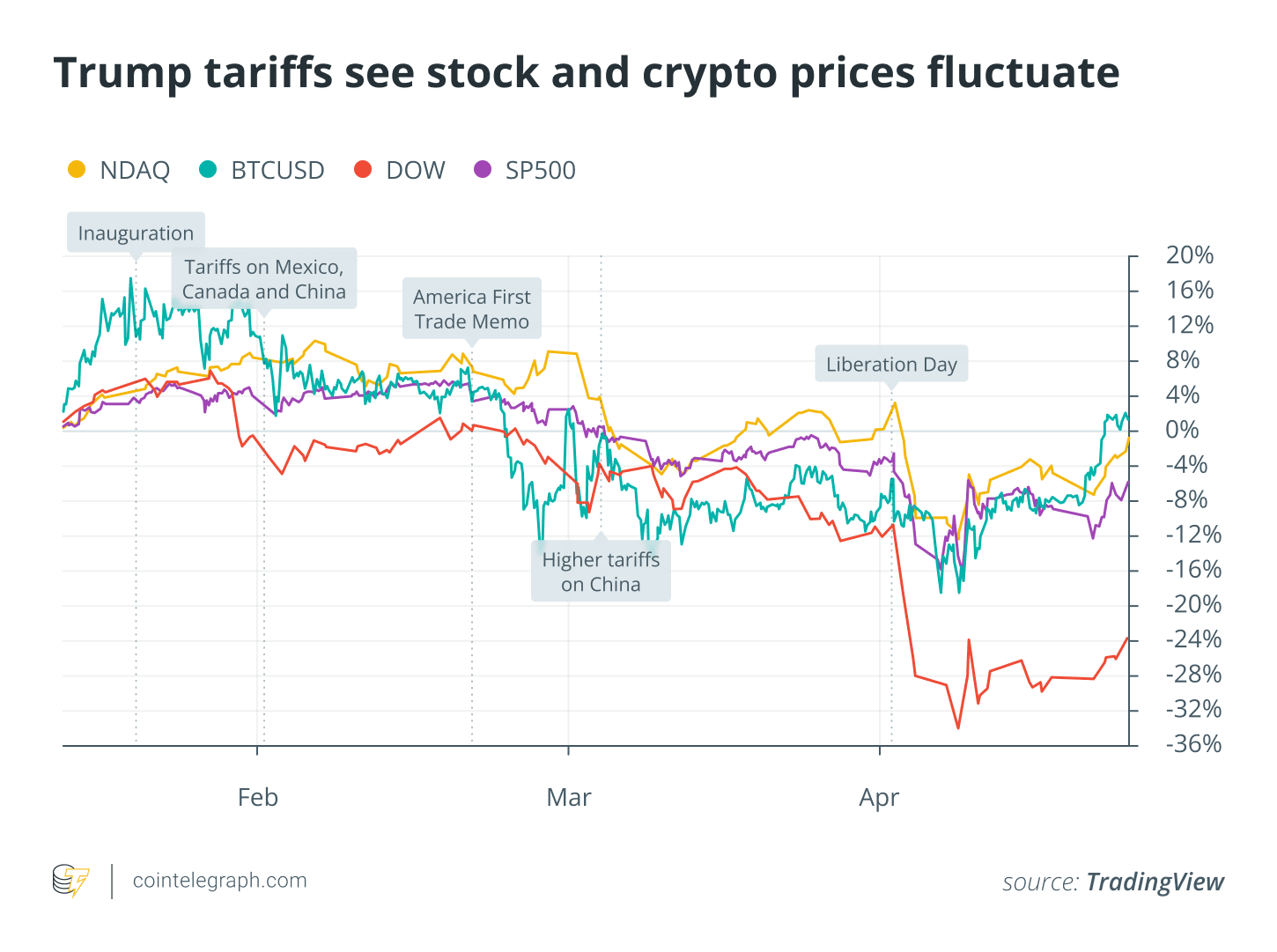

Trump’s trade war with the entire world has had the largest short-term impact on crypto markets, as crypto prices have wavered amid macroeconomic worry and uncertainty. Higher prices on electronics mean Bitcoin ( BTC ) miners are struggling to turn a profit, and worries about moving away from the dollar are widespread.

Nevertheless, cryptocurrency markets have demonstrated notable toughness and reasons for hope due to the administration’s friendly stance toward cryptocurrencies. Several supporters of blockchain technology have taken up important roles within major governmental bodies such as the Securities and Exchange Commission and the Commodity Futures Trading Commission (CFTC). Additionally, an eagerly awaited regulatory structure specifically designed for the crypto sector is finally approaching.

During Trump's initial 100 days, the cryptocurrency sector experienced significant transformations, and it seems these developments are just beginning. Below is an overview of the key events that have transpired thus far.

Jan. 20 — The first 100 days of Trump's presidency begin with the launch of a memecoин

On January 20, as Trump was being sworn in at the Capitol Building's rotunda, his family’s cryptocurrency investment company, World Liberty Financial (WLFI), initiated its second token sale for WLFI coins.

Substantial interest caused prices to jump at first; however, the actual worth of these tokens remains unclear. Since WLFI can neither be transferred nor listed on any exchanges right now, their genuine value has yet to be established.

The meme coin acted as a launchpad for Trump’s cryptocurrency initiative, leading to an unparalleled level of backing for the sector within Washington, D.C., alongside growing moral and ethical apprehensions among both watchers and politicians.

Related: Trump's cryptocurrency ventures with WLFI aren't yielding profits.

January 20—Pro-crypto advocates take charge of federal agencies on "day one"

The U.S. President influences various federal regulatory bodies, such as those regulating cryptocurrencies. Shortly after taking office, Trump moved quickly to nominate individuals who were supportive of cryptocurrency to lead key organizations like the SEC, the CFTC, and other significant federal agencies.

On "day one" of his presidency, Trump nominated businessman Paul Atkins to head the SEC. Atkins would take over from Gary Gensler, whom many within the cryptocurrency sector viewed as opposed to wider acceptance and advancement of the industry.

On day one, Trump named entrepreneur and cryptocurrency investor David Sacks as the head of the President’s Council of Advisors on Science and Technology, effectively making him the go-to person for matters related to cryptography and artificial intelligence.

Atkins wouldn’t be confirmed By the Senate until April 9 and then inaugurated on April 21. However, during this interim period, Trump also contacted ex-CFTC Commissioner and cryptocurrency supporter Brian Quintenz to lead that organization.

Jan. 21 — The $500 billion Stargate AI project

At a press briefing, Trump unveiled a $500 billion private-sector AI infrastructure plan An investment initiative dubbed "Stargate" was announced by the president. This project, spearheaded by OpenAI, the creators of ChatGPT, along with SoftBank and Oracle, aims to generate approximately 10,000 new job opportunities for Americans.

Open the Youtube video

Trump said the US needed to lead the world in AI innovation and keep development onshore. “China is a competitor, others are competitors. We want it to be in this country, and we’re making it available,” he said.

OpenAI asserted that the initiative would "not just facilitate the reindustrialization of the U.S., but also offer a strategic capacity for safeguarding the national security of both America and its allies."

Jan. 21 — Clemency for Silk Road creator Ross Ulbricht

Trump announced on Truth Social that he had called the family of Silk Road 2.0 founder Ross Ulbricht after commuting his sentence.

Following his detention in 2013, Ulbricht was given a life sentence in prison in 2015 without the chance of being released from prison for his part in helping with the smuggling of drugs and various illegal materials.

Ulbricht's case turned into a focal point for both libertarian groups and proponents of prison reform. Libertarians who were interested in cryptography rallied behind Ulbricht because his platform was among the earliest where individuals had the opportunity to use Bitcoin for transactions.

Releasing Ulbricht was among the numerous pledges Trump made during his campaign. reached out to the cryptocurrency community .

Jan. 23 — Prohibition of digital currency, setting up a cryptocurrency task force

Through an executive directive, Trump set up an internal task force aimed at positioning the U.S. as the global leader in cryptocurrency. Additionally, the directive banned "the creation, distribution, usage, and adoption" of a U.S. central bank digital currency (CBDC).

CBDCs are a contentious issue in the crypto community, with many privacy activists claiming that they are another form of state surveillance and government control. Enthusiasm over their creation from central bankers has further set the more libertarian-minded crypto community against their creation.

The working group would kickstart the process for creating the forthcoming US Bitcoin and crypto reserves.

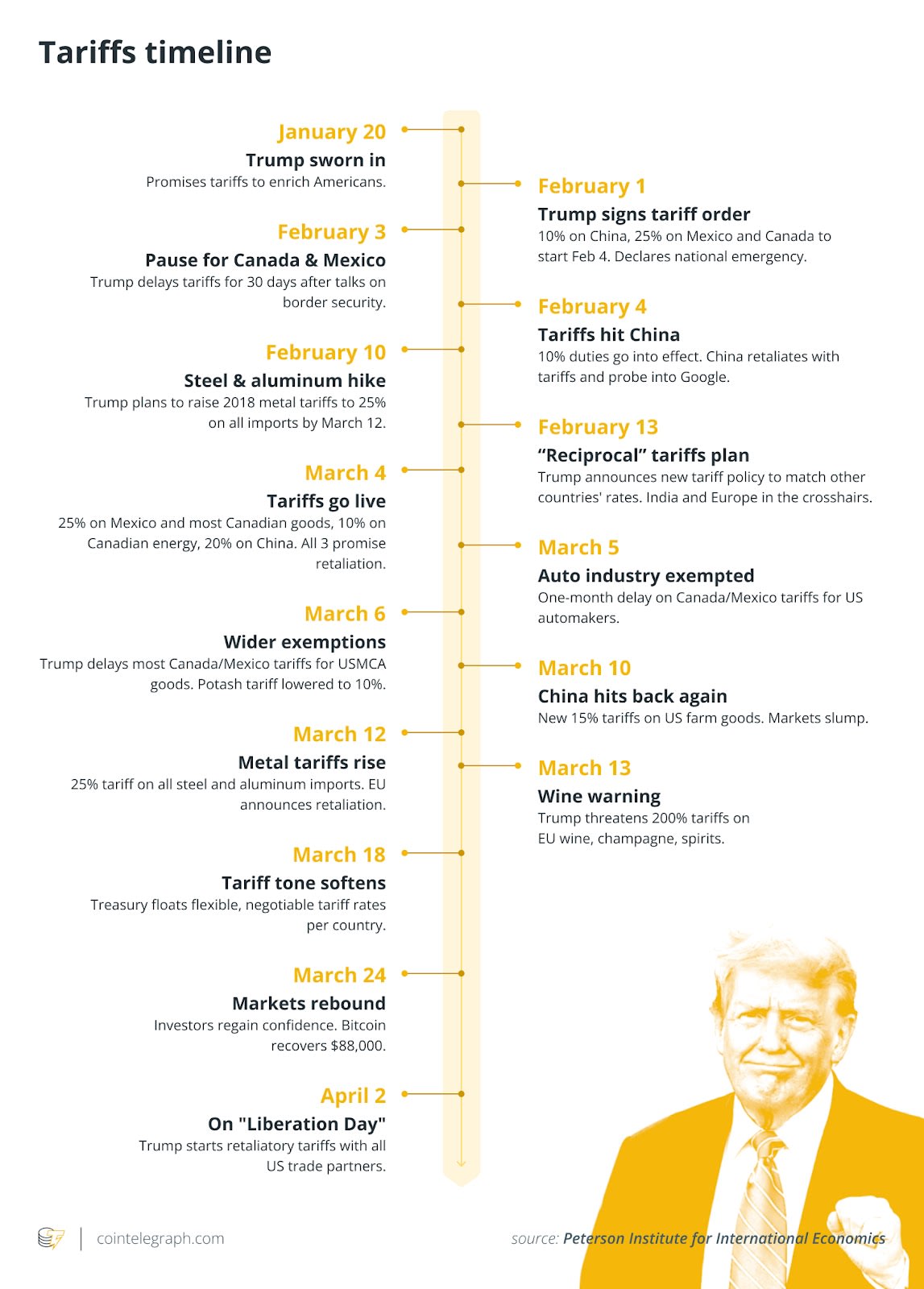

February 1 - The trade conflict kicks off with imposition of tariffs on Mexico, China, and Canada.

A key pledge from the Trump campaign was to address the "poor agreements" that the U.S. had made with several of its longest-standing allies and crucial trade partners.

A little more than a week following his inauguration, Trump declared extensive tariffs on Canada, Mexico, and China, referencing issues related to border security and the alleged increase in cross-border trade of fentanyl originating from these nations.

The same day, Canada announced retaliatory measures. On Feb. 3, Mexico promised to step up security of its northern border, responding to American requests for increased patrols. This led Trump to reverse initial tariff plans on both countries.

Unforeseen antagonistic tariffs imposed by a close partner and ally caused stocks and cryptocurrency values to plummet. These actions signaled the onset of widespread economic instability that would typify the initial period of the Trump administration.

Feb. 12 — Swap of Vinnik-Foegel prisoners with Russia

Alexander Vinnik, the convicted money laundering perpetrator who moved Bitcoins taken during the notorious Mt. Gox hack through his cryptocurrency platform BTC-e, went back to his homeland, which is Russia .

Vinnik pled guilty to money laundering conspiracy charges in 2024. BTC-e processed more than $9 billion in transactions and had over 1 million users worldwide, many of whom were in the US.

Vinnik was exchanged for American schoolteacher Marc Fogel, who was teaching at the Anglo-American School of Moscow and had been in a Russian jail since 2021 after being arrested for illegal possession of cannabis.

Feb. 18 — Bankman-Fried makes veiled plea for release

In an interview with The New York Sun, the ex-CEO of the defunct crypto exchange FTX, Sam Bankman-Fried, tackled the contentious issue of his political donations , stating that the Republican Party has historically been "much more sensible."

Bankman-Fried, also known as SBF, made well-known donations to the Democratic Party as he allegedly sought to shape lawmakers' stance towards the digital currency sector. Subsequently, it emerged that SBF was simultaneously contributing substantial sums to Republicans; however, the precise sum donated to them is unclear.

Open the Youtube video

During the interview, SBF compared his situation to Trump’s, asserting that he was unjustly targeted by the criminal justice system. He also cast doubt on the actions of the federal judge presiding over his case, Judge Lewis Kaplan. "President Trump expressed many grievances about Judge Kaplan. I shared those same concerns."

Spectators viewed the interview as a move by Trump aimed at securing a pardon for him. Roger Ver, an early supporter of Bitcoin who is now confronting criminal tax evasion allegations, has made an outright appeal .

March 7 -- Trump sets up Bitcoin reserve and gathers cryptocurrency stash

On March 7, during his 46th day in office as president, Trump signed an executive order setting up a "Strategic Bitcoin Reserve." During his campaign, Trump pledged significant support for cryptocurrency adoption, which included the potential creation of a much-anticipated Bitcoin reserve.

However, the US reserve might not meet the expectations of Bitcoin maximalists. Instead of devising a clear strategy for the U.S. government to acquire and store Bitcoin, they established just one fund meant to aggregate all Bitcoins confiscated through legal actions.

Although the directive indicates that the administration can buy extra Bitcoin, it has to accomplish this in a manner that is neutral regarding the budget.

Alongside the Bitcoin reserves, Trump set up a US Digital Asset Stockpile that includes other cryptocurrencies like Ether ( ETH ), Solana ( SOL ), XRP ( XRP ) and Cardano ( ADA ).

March 7 -- White House Cryptocurrency Summit

Cryptocurrency leaders headed to Washington for a gathering at the White House. talk about a broad spectrum of subjects linked to cryptocurrency regulations and the growth of the sector within the U.S.

The attendees comprised Strategy's executive chairman Michael Saylor, Coinbase’s CEO Brian Armstrong, and "crypto czar" David Sacks.

Although certain participants, such as Sergey Nazarov who is a co-founder of ChainLink, were hopeful regarding the event’s emphasis on bolstering the U.S. cryptocurrency sector, several prominent figures in the crypto world who weren’t included expressed disappointment.

Charles Hoskinson, the co-founder of Cardano and IOHK who was absent from the event, highlighted in a video stream that genuine transformation—specifically, legislative action—needs to occur within Congress.

“Everybody focuses on the White House because it’s simple and easy to do so. [...] And as much as we, as an industry, want this to be a short process, it’s going to be a long and methodical process,” Hoskinson said.

Others express it more straightforwardly:

March 25 -- WLFI stabilizes with the use of stablecoins

In March, WLFI broadened its services with the discreet release of its stablecoin called USD1. This digital token is "fully supported by short-term U.S. Treasury bills, U.S. dollar deposits, and other liquid assets." It was introduced on both the Ethereum and Binance Smart Chain platforms.

The announcement about the token's release came only a few days after WLFI. secured more than $500 million By selling its own WLFI tokens.

US lawmakers subsequently requested an ethical investigation into WLFI They pointed out the president’s capacity to shape stablecoin policies as a significant conflict of interest regarding the initiative.

Related: Atkins takes over as the new SEC chief: What does this mean for the cryptocurrency sector?

April 2 - Freedom Day

Sticking to his confrontational approach to trade policies, Trump imposes tariffs on all U.S. trading partners, labeling this day as "Liberation Day."

At a special event at the White House, Trump signed an executive order levying reciprocal tariffs For each nation imposing duties on American products, beginning with a minimum rate of 10%.

Following the order, markets experienced broad-based declines, with many economists expressing worries about an impending recession. U.S.-based crypto miners faced additional pressure as their operational expenses, particularly for purchasing new mining equipment, rose considerably.

Anthony Scaramucci, who previously served as the White House Communications Director, stated to Cointelegraph, "In my view, he has experienced the toughest 95-day period in recent presidential history. Although the markets have somewhat rebounded, they've still lost around $9 trillion in value. We started with an expanding economy that seems to be sliding towards either a moderate or severe recession."

He stated that Trump initiated a trade war "with no actual weapons" and later misrepresented the advancements when the president asserted that China was trying to engage in negotiations.

“The lies are ok — everyone accepts that he’s a congenital liar [...] but when you’re declaring war on people and then you’re lying, it’s really bad.”

April 25 — Fundraiser dinner with a $300,000-per-plate meme coin sparks calls for impeachment

Top Trump meme coin holders were supposedly given the chance to enjoy a dinner With the President, reigniting worries about his cryptocurrency initiative and leading to a U.S. legislator backing impeachment proceedings.

During a town hall event in his home state of Georgia, Democratic Senator Jon Ossoff expressed strong support for impeachment. He stated, "If the current U.S. President is offering access in exchange for payments essentially going directly into his pockets, this undoubtedly qualifies as grounds for impeachment."

Social media rumors suggested that $300,000 would provide token holders with access to meet the President, but this was not confirmed by the Trump administration. later denied .

Trump's initial 100 days might put reforms at risk.

The initial 100 days of Trump’s presidency have ushered in unprecedented transformations within the cryptocurrency sector. At the same time, these changes have exposed the industry to heightened scrutiny and debate due to the president’s personal connections to blockchain initiatives, which spark ethical concerns.

These controversies may well jeopardize the industry’s efforts to effect change in Congress, according to Scaramucci, who said, “Trump has so inflamed everything that he’s made it even hard for [stablecoin legislation] to happen.”

The STABLE Act, designed to establish guidelines for stablecoin distribution within the U.S., was introduced on March 26 in the House of Representatives was approved by a committee vote on April 3rd , with leading Democrats disagreeing. The legislation is set to move forward for an overall vote on the floor before proceeding to the Senate.

The Senate’s GENIUS Act has lately gained momentum. passing a vote in the Banking Committee , largely along party lines.

Magazine: Bitcoin's $100K aspirations deferred, SBF's enigmatic incarceration shift: Hodler’s Digest, April 20 – 26

Post a Comment for "Trump's First 100 Days 'Worst Ever,' Even With Crypto Promises"