Crypto Boom Poses Threats to Investors and Financial Stability, Warns Bank of Italy

The Bank of Italy highlighted Bitcoin and other digital assets as new risk factors in a recent report. citing worries for both investors and the overall financial system.

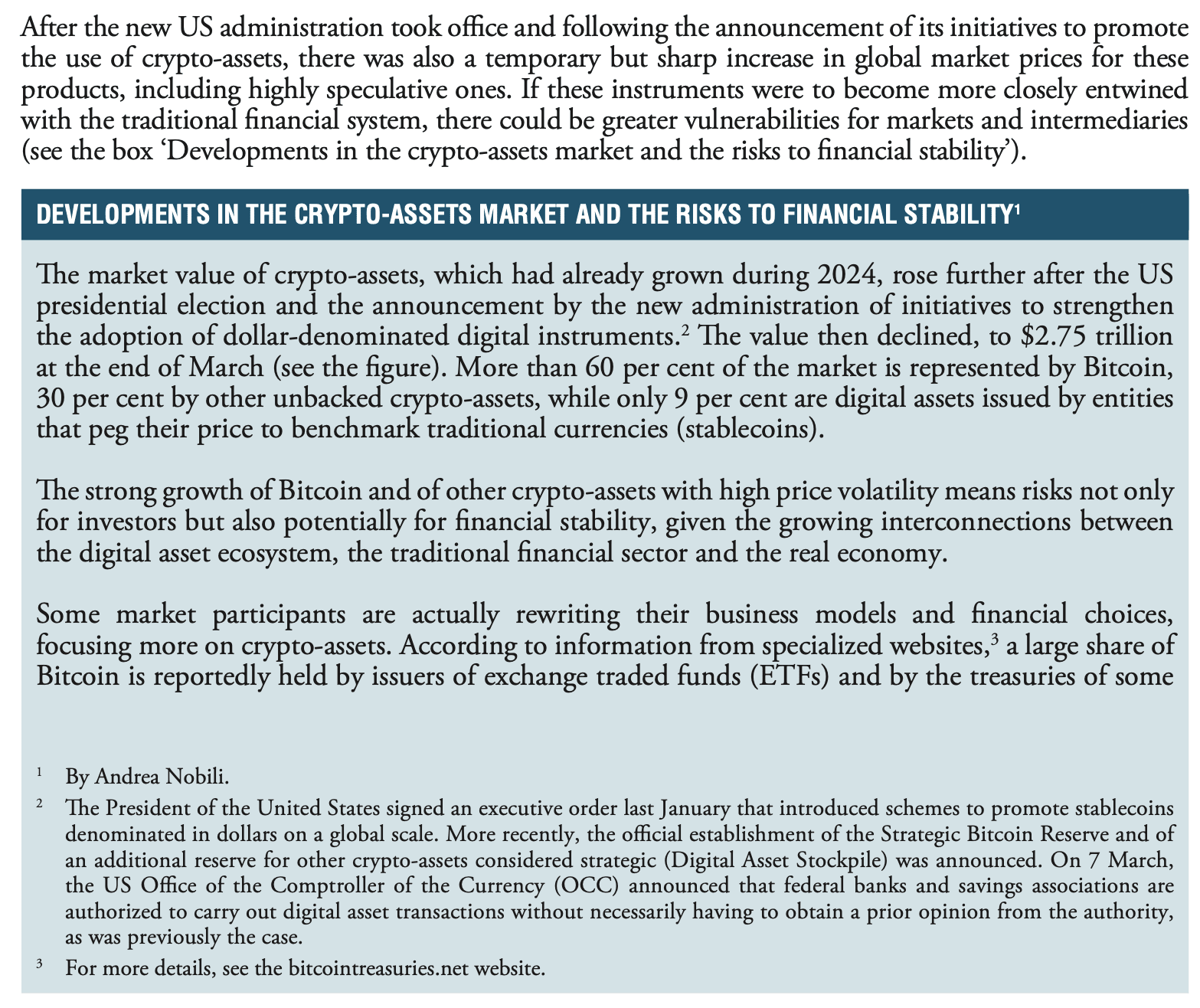

The Bank of Italy highlighted crypto volatility and increasing ties with the overall economy in its April 2025 Financial Stability Report. The report specifically points to stablecoins and thecrypto investments held by non-financial companies as major areas of concern.

The robust expansion of Bitcoin along with othercrypto assets characterized by significantprice fluctuations poses risksnot justfor investorsbutalso possiblyforfinancial stability, consideringthe increasing connectionsbetween thedigitalasset ecosystem,the conventional finance industry, andthereal economy," the report states.

The Bank of Italy's report similarly touched upon the phenomenon of non-financial companies accumulating Bitcoin, noting that this subjects them to significant price fluctuations fueled by the perception that Bitcoin may bolster their stock values.

Strategy (previously known as MicroStrategy) played a key role in mainstreaming businesses' acquisition of Bitcoin, starting their purchases in August 2020. Following suit, numerous firms have since joined this trend. have followed Its leadership includes companies like Metaplanet, Semler Scientific, and GameStop.

In its report, the Bank of Italy discussed stablecoins, pointing out possible dangers should dollar-linked coins gain systemic importance. The bank indicated that greater dependence on U.S. Treasury securities to support such assets might lead to wider financial instabilities. As stated in the document, disturbances within either the stablecoin market or the associated bonds could result in "consequences for various sectors of the worldwide financial network."

The report was issued shortly following warnings from Giancarlo Giorgetti, Italy’s Minister of Economy and Finance, who cautioned against underestimating the attractiveness of U.S. dollar stablecoins. In his statement, Giorgetti expressed concerns over current U.S. stablecoin regulations. pose greater risks than US President Donald Trump’s tariffs .

Related: Italy reduces planned increase in cryptocurrency tax rate, report says.

Open the Youtube video

In his address, Giorgetti emphasized the importance of strengthening the euro’s standing globally, pointing out that the advancement of the Digital Euro will be essential in decreasing dependence on external digital alternatives.

Related: Italy's biggest bank joins the cryptocurrency market with a $1 million Bitcoin investment.

Post a Comment for "Crypto Boom Poses Threats to Investors and Financial Stability, Warns Bank of Italy"