Labor Pain, Crypto Gain: Weak JOLTS Data Paves Way for Bitcoin Rally

Key points:

Macroeconomic factors have consistently been viewed as significant determinants of cryptocurrency values. Typically, Bitcoin's BTC ) and alternative coins fare badly when investors are concerned about deteriorating employment and consumer data.

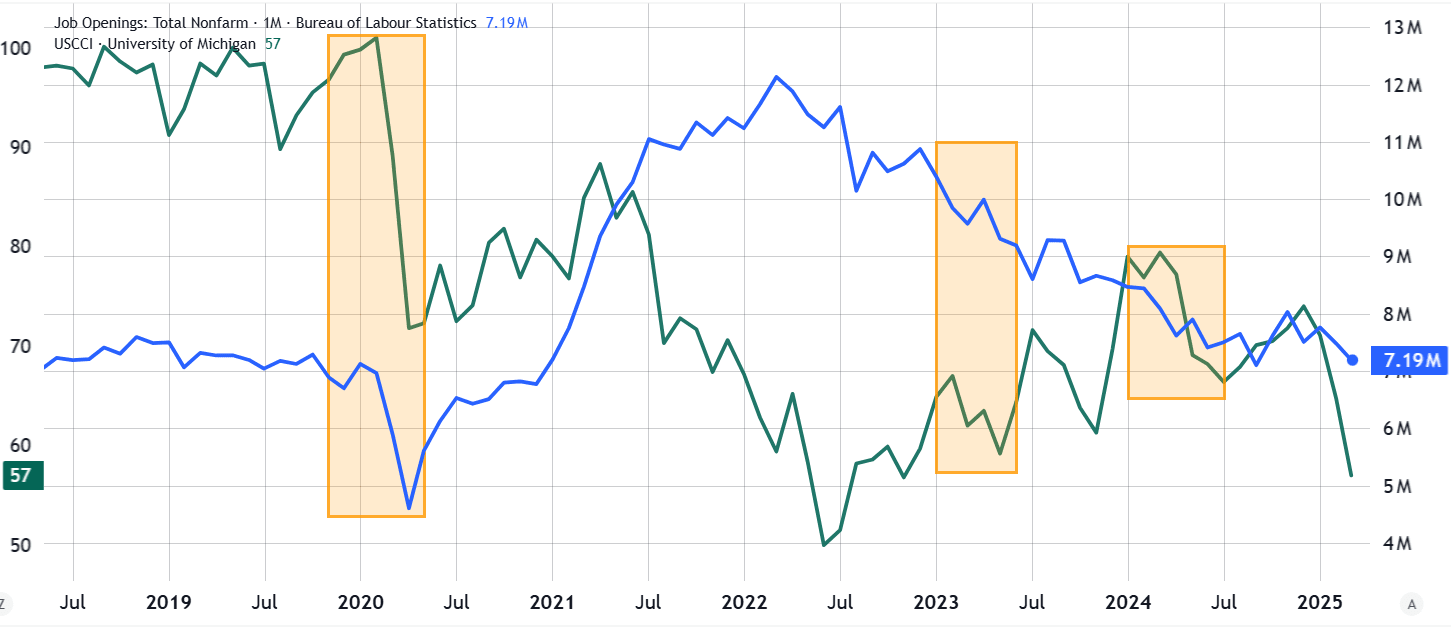

The US Labor Department’s JOLTS report published on April 29 revealed that job openings in March were nearing their lowest figures in four years. In March, American companies advertised approximately 7.2 million open positions, which falls short of the predicted 7.5 million spots anticipated by economists. Additionally, U.S. consumer confidence declined for five consecutive months in April, hitting its lowest mark since January 2021.

Deteriorating circumstances increase the likelihood of central banks implementing economic stimulus measures, which makes the resultant effect on cryptocurrency markets unclear. additional liquidity promotes investment in high-risk assets such as Bitcoin, as increased capital enters the economy.

Future prospects carry greater weight than current sluggish economic figures.

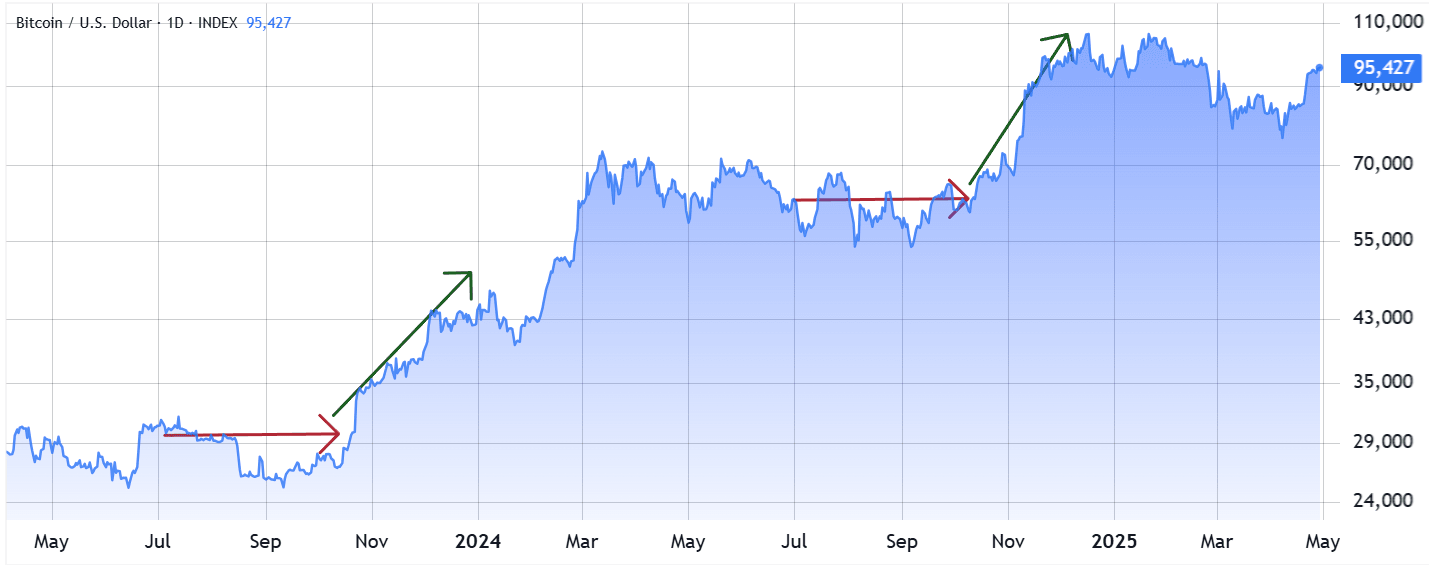

The previous instance of a decline in U.S. job opportunities along with diminished consumer trust occurred from January through June 2024. During the subsequent three-month period, Bitcoin's value fluctuated within the range of $53,000 to $66,000. This was followed by an impressive 60% surge starting around mid-October, which drove BTC prices past the $100,000 mark. Despite the ultimate outcome being favorable, it required over 105 days before these effects became evident in the crypto markets.

Even though these circumstances might appear concerning initially, softer labor and consumer confidence typically reflect historical trends. Both financial institutions and businesses make choices based on anticipated economic expansion instead of solely relying on previous statistics. Additionally, enhanced optimism within the cryptocurrency sector generally emerges once evidence supports more favorable overall economic situations. Therefore, the observed 105-day delay should not be seen as extraordinary.

Prior to 2024, a comparable scenario unfolded from January through June of 2023, marked by decreases in employment statistics and consumer optimism. Over the subsequent four months, conditions remained challenging as Bitcoin’s value dropped by 18%, settling at around $25,000. It required 115 days for the cryptocurrency to rebound and climb back up to approximately $30,500 towards the end of October. Nevertheless, the ensuing two-month period was highly favorable; during this time, BTC surged by 45%, reaching an impressive high of about $43,900.

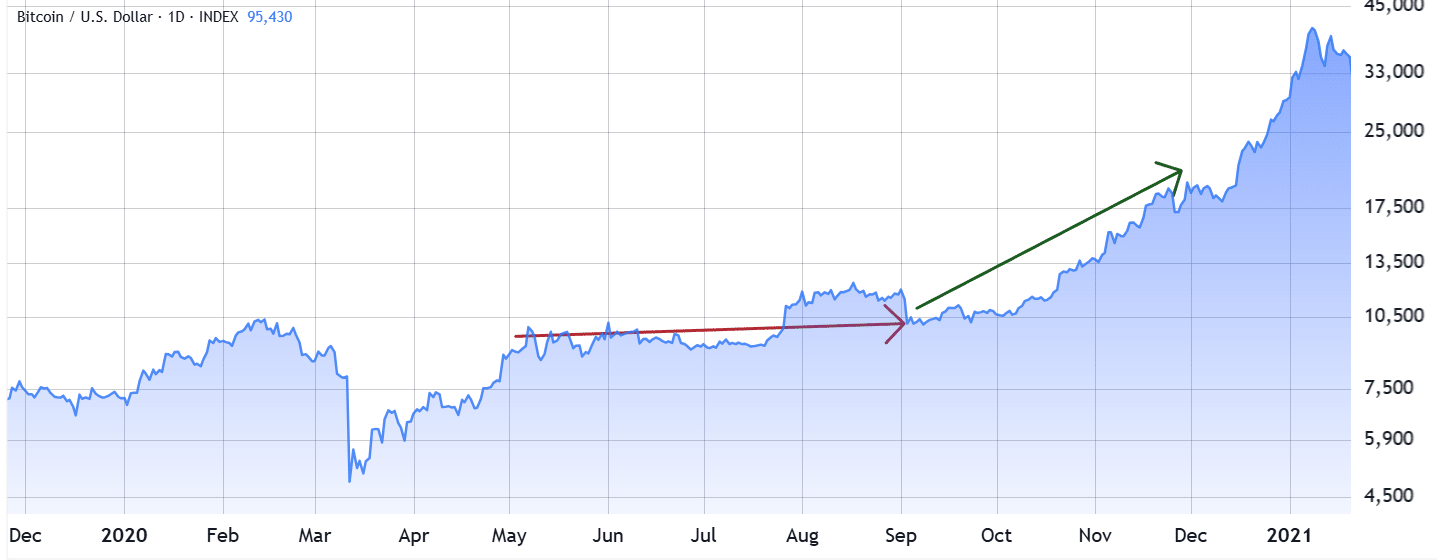

The most recent instance over the past eight years where both employment levels and consumer optimism plummeted substantially occurred from February 2020 through May 2020, immediately following the introduction of COVID-19 restrictions. During this timeframe, on March 13, 2020, Bitcoin’s value temporarily fell beneath $4,000. Consequently, a prolonged period of consolidation as anticipated once investor confidence was restored in the cryptocurrency markets.

Related: Bitcoin serves as a 'store of value' amidst the turmoil caused by Trump's policies, says NYDIG.

Can Bitcoin reach $140,000 by October?

When examining the broader economic indicators, we see that during the period from May 2020 to September 2020, Bitcoin did not experience significant fluctuations; its value rose modestly from $8,900 to $10,600, marking a gain of about 20%. Yet, over the following sixty-day span, there was a dramatic surge with Bitcoin climbing impressively to reach approximately $19,700—a substantial increase of 85%. This pattern repeated itself for the third instance where diminished labor market strength and lower consumer confidence appeared ahead of another upswing in Bitcoin’s pricing.

Although the duration from the worst state of economic indicators to Bitcoin’s upturn varied between 105 and 130 days across all instances, the outcome remained consistent each time. Consequently, should U.S. employment opportunities and public optimism about the economy enhance starting in April 2025, it might lead to an increase in Bitcoin’s value by around mid-July. Should past patterns hold true, this may indicate a floor for Bitcoin’s pricing at least. target of $140,000 By October 2025, additional favorable economic indicators will be necessary to validate this prediction.

The content of this article serves informational purposes only and does not constitute legal or financial advice. The perspectives, feelings, and viewpoints presented herein belong solely to the writer and do not necessarily express or embody those held by Cointelegraph.

Post a Comment for "Labor Pain, Crypto Gain: Weak JOLTS Data Paves Way for Bitcoin Rally"