WeightWatchers Soars on Eli Lilly’s Zepbound Deal: Retail Investors Bullish

Shares of WW International Inc., commonly recognized as Weight Watchers, experienced significant volatility once more on Tuesday following the announcement of a new partnership aimed at capitalizing on the rapidly growing market for weight-loss medications.

The corporation's stock price surged twofold during midday trading before closing the day up by 77%. It saw an additional increase of more than 9% in after-hours trading.

WW announced that it has incorporated Eli Lilly's (LLY) LillyDirect pharmacy service, known as Gifthealth, into its system to simplify obtaining the FDA-approved weight-loss medication, Zepbound.

WeightWatchers announced that self-paying patients who qualify and do not have insurance coverage can obtain prescriptions for Zepbound in single-dose vials via their app.

The firm reports that interest in Zepbound has increased significantly amongst WeightWatchers Clinic participants, particularly noting that the number of scripts written for the injectable form has more than doubled over the past few months.

At present, 33% of clients at WeightWatchers clinics incorporate Zepbound into their weight management program.

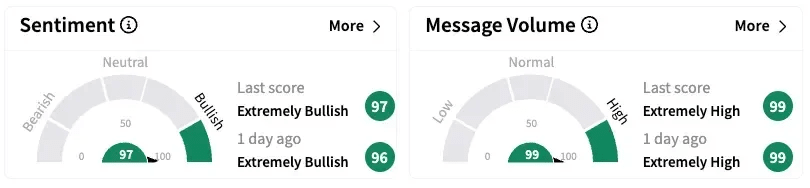

On Romero.my.id, the retail sentiment for the company moved further into the 'extremely bullish' territory.

This development follows bankruptcy filings and just a few days after an activist investor expressed interest in the company.

Earlier this month, reports It came to light that WW was contemplating filing for Chapter 11, causing its stock price to drop dramatically by 62% in one day.

On Friday, Galloway Capital Partners reported owning a 2.87% stake in the firm and called for avoiding bankruptcy considerations, which resulted in an impressive 168% surge in stock value.

Although WeightWatchers has not made any statements regarding a possible bankruptcy plan, its operations continue to face significant challenges.

Over the past three consecutive years, the firm’s income has dropped between 11% and 14%. Additionally, earlier this year, S&P Global Ratings lowered their assessment of the company's debt.

Shares of WeightWatchers have dropped 42.4% so far this year.

To request updates or corrections, send an email to newsroom[at]Romero.my.id[dot]com.

Post a Comment for "WeightWatchers Soars on Eli Lilly’s Zepbound Deal: Retail Investors Bullish"