Who Really Calls the Shots in Crypto Decision-Making? Study Casts Doubt on Its Democratic Promise

As Donald Trump returns to the White House, cryptocurrencies are continuing their upward trajectory. Under his administration, there seems to be a preference for minimal intervention when it comes to regulating cryptocurrency. Furthermore, an executive directive released in January instructed government bodies not to work on establishing a U.S. central bank digital currency—often referred to as a "digital dollar." This move apparently tilts towards supporting individual private cryptos and stablecoins instead.

In this evolving economic environment, Decentralized Autonomous Organizations (DAOs) are celebrated as a move towards a more equitable financial future, providing principles of fairness, openness, and collective governance. Nonetheless, the actual process of making decisions inside these organizations might fall short of such democratic ideals.

Who holds the power?

In contrast to conventional firms where executives such as CEOs or CFOs typically handle decision-making processes, decentralized autonomous organizations (DAOs) function based on grassroots democracy. In these entities, management is carried out by community members who collectively have a say over significant choices—ranging from fund allocation strategies to fee structures and even software update implementations. The votes inside a DAO are executed through governance tokens, which serve as digital shares providing their owners with voting privileges.

Yet, who truly possesses these governance tokens—and the authority they signify?

"Theoretically, all users have the opportunity to engage in the decision-making process. Nonetheless, it’s uncertain who these users truly are since their identities are concealed behind pseudonymous addresses," explains CSH researcher Stefan Kitzler.

A handful rules over the multitude.

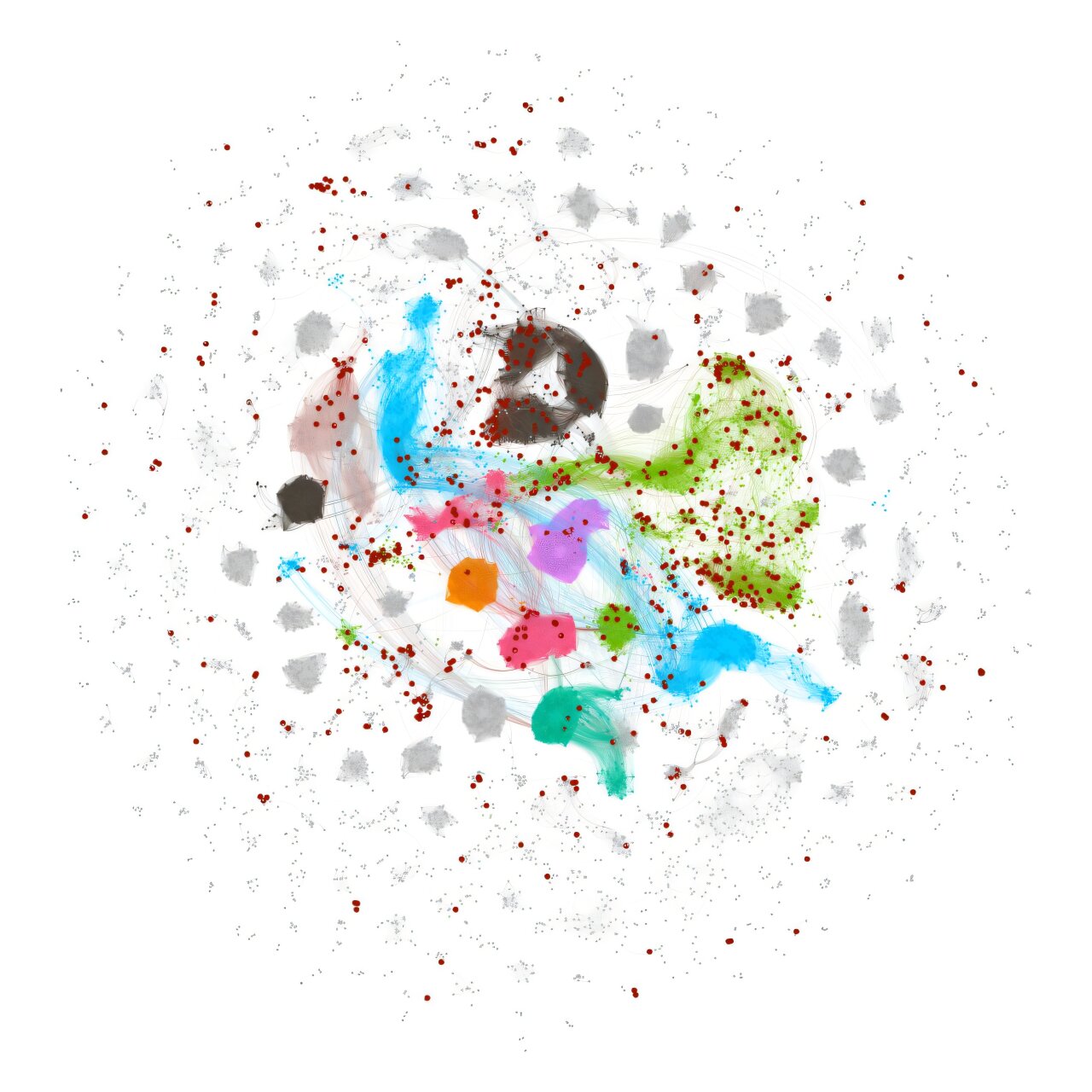

Through their examination of the role played by key stakeholders in the decision-making process, Kitzler and his team challenged the extent to which these organizations can be considered truly decentralized. They questioned study , published in Financial Cryptography and Data Security reveals that the expectation of openness and democratic principles frequently comes into conflict with the actuality of power being held by a few.

"Often, governance tokens end up being heavily concentrated among a small group of initial supporters or investors," according to Kitzler.

The team examined 35,124 proposals submitted by 872 decentralized autonomous organizations (DAOs), which involved 986,557 voters. Their analysis revealed that in 7.54% of these DAOs, contributors like developers, administrators, or project owners dominated the voting power, allowing them to sway decision-making processes. Approximately 20% of the studied DAOs saw contributors unilaterally deciding at least one proposal.

A real case

In 2022, the U.S. government imposed sanctions on Tornado Cash, a prominent decentralized autonomous organization (DAO) platform. Officials claimed that the tool had been utilized for washing funds connected to North Korean cybercriminals. Subsequently, two individuals involved as developers in the project faced arrest. Despite the intended decentralization inherent in DAO structures aimed at dispersing authority, this incident sparked worries over potential backdoor decision-making controlled primarily by select internal members.

According to Kitzler, our research revealed indications of 'inner circles' emerging across numerous DAOs, as participants usually occupy central roles within theDAO governance landscape and frequently wield significantly greater power than others.

We've occasionally observed indications of one-sided control even within sizable DAOs handling millions of dollars," notes Bernhard Haslhofer, who heads the Digital Currency Ecosystems research group at CSH. "This finding was unexpected.

Shifting tokens, shifting power

The private nature of blockchain transactions complicates the identification of actual token holders, making the governance process opaque and possibly susceptible to tampering.

The researchers observed a pattern where governance tokens were frequently transferred just prior to significant votes, suggesting potential strategic actions—or even possible manipulations—in theDAO’s decision-making procedures.

As cryptocurrencies regain their prominence and debates over regulations intensify globally, this research emerges at a critical juncture.

Growing demand exists for comprehending how these systems operate," states Haslhofer. "Our research offers practical knowledge that can aid in crafting upcoming regulations—enabling DAOs to fulfill their initial potential.

The research titled "The Governance of Decentralized Autonomous Organizations: An Examination of Contributors' Impact, Networking, and Alterations in Balloting Authority" authored by Stefan Kitzler, Stefano Balietti, Pietro Saggese, Bernhard Haslhofer & Markus Strohmaier was featured in the Lecture Notes in Computer Science book series. International Conference on Financial Cryptography and Data Security .

More information: Stefan Kitzler and colleagues explored how contributors influence governance within decentralized autonomous organizations. Their study examines networks and changes in voting power among participants. Financial Cryptography and Data Security (2025). DOI: 10.1007/978-3-031-78679-2_17

Furnished by the Complexity Science Hub Vienna

The tale was initially released on Romero.my.id . Subscribe to our newsletter For the most recent updates on science and technology.

Post a Comment for "Who Really Calls the Shots in Crypto Decision-Making? Study Casts Doubt on Its Democratic Promise"